According to von NotHaus:

For approximately six hours they took all the gold, all the silver, all the platinum and almost two tons of Ron Paul Dollars that where just delivered last Friday. They also took all the files, all the computers and froze our bank accounts.

. . .

But to make matters worse, all the gold and silver that backs up the paper certificates and digital currency held in the vault at Sunshine Mint has also been confiscated. Even the dies for mint the Gold and Silver Libertys have been taken.

At first glance, it sounds like the evil totalitarian government squashing freedom, doesn't it?

Well, no.

The Liberty Dollar scheme debuted in 1998, when Bernard von NotHaus proposed a new privately-run currency based on silver and gold to compete directly with the official government-issued currency of the United States. His sales pitch took advantage of two interconnected movements within the Libertarian Party: belief that the Federal Reserve Bank is part of a conspiracy to rule the US/world, and belief that fiat money is fraud and should be replaced by a commodity-based currency, preferably the gold standard.

Originally NotHaus marketed the Liberty Dollar as part of a movement to overthrow the Federal Reserve, NORFED- National Organization for the Repeal of the Federal Reserve Act (and the Internal Revenue Code). The organization's name was changed at the end of last year to, in the words of NotHaus, "Since its founding by Bernard von NotHaus, the Liberty Dollar has consistently gathered momentum by becoming more main stream. Along the way, the Masthead was changed from NORFED to The Liberty Dollar when the emphasis was placed on the product (Liberty Dollar) and instead of the company (NORFED). Finally, when it became obvious that the political baggage of NORFED was a hindrance to the Liberty Dollar becoming the everyday currency of choice for millions of Americans, NORFED was dissolved and this site was created as the historic site."

To quote the website:

Remember when gas was only 25-cents a gallon? You could take a dollar down to the gas station and buy four gallons for a buck! At that time our dollar was backed by REAL money, real silver. Guess what? That same amount of silver still buys four gallons of gas! That just shows that real money like gold and silver holds its value and it is the green paper money that is now worth a lot less. As a matter of fact, when you think about it, you realize that gas, food, and almost everything else has NOT gotten more expensive. It only seems that way because the value of the green paper money is worth less and less and so it takes more and more of it to buy the same goods and services. Most people think prices have gone up, but in reality: it is the value of the US dollar that has actually gone down. Luckily, now there is a simple and profitable solution to the coming inflation - good old-fashioned, REAL money as the Founders intended. Look at these charts by the US government.

. . .

Now you can profit from the coming inflation with the inflation proof REAL money - the 100% gold and silver Liberty Dollar.

. . .

Paper money backed only be government debt is bad for everyone! That's why I created the Liberty Dollar.

The Liberty Dollar is the second-most popular and the fastest-growing currency in America! It's backed by gold and silver instead of being backed by national debt like our familiar Federal Reserve Notes. When you hold the Liberty Dollar, you own silver. When you give this REAL money to someone as payment, they now own silver. Pretty neat, huh?

On the other hand, when you hold a Federal Reserve Note, you own debt that you will eventually have to repay. When you give a Federal Reserve Note to someone as payment, they now have debt. Ouch!

. . .

That analogy is the Liberty Dollar. Liberty Dollars are backed by silver. You can use the front, like cash - or the back, for silver. Silver is a valuable commodity whose price has been going up! Silver is used in photography, jewelry, electronics, and industrial production. You may not use silver yourself, but there's a worldwide market for it! Simply by choosing a more valuable money, REAL money, you can profit!

. . .

Just as FedEx brought competition to the Post Office and it became incredibly successful, the Liberty Dollar emulates the same model by bringing competition to our country's monetary system. Now you can become incredibly successful too.

The Liberty Dollar brings free enterprise to the creation of money. Doesn't it just make sense that when the underlying commodity increases in value the purchasing power of the currency should increase in value? Well that is exactly what happened on Thanksgiving Day 2005 - the Liberty Dollar Moved Up from the $10 Silver Base to the new $20 Silver base and all Liberty Dollars DOUBLED in value. Just imagine, while your US Dollars are losing purchasing power, the Liberty Dollar is rewarding those who have started using the new gold and silver based currency by keeping pace with inflation, caused by the decline of the US Dollar.

The important "unit of accounting" of the Liberty Dollar is exactly the same as the US dollar so it functions dollar-for-dollar with the current Federal Reserve Note (US dollar) and makes it very easy for merchants and customers to use it.

Local merchants find the Liberty Dollar particularly beneficial, as REAL MONEY is profitable, circulates freely, builds traffic, grows their business, and increases customer loyalty.

The Liberty Dollar was specifically designed circulate in the community for the advantage of the local economy and stay in the community, so REAL money may not be deposited into a bank. Because it cannot be whisked away, the Liberty Dollar will remain in your community - and circulate for the good of both the merchants and consumers.

. . .

In the process, of course, the Liberty Dollar would drive the Federal Reserve out of business- never mind the simple fact that this logic flies in the face of Gresham's Law, which states that bad money drives out good from circulation in a legal-tender system.

In any case, let's go back and counter some of these claims...

Remember when gas was only 25-cents a gallon? You could take a dollar down to the gas station and buy four gallons for a buck! At that time our dollar was backed by REAL money, real silver. Guess what? That same amount of silver still buys four gallons of gas!

Well, no, actually I don't remember 25-cent gas. I was born after the 1973 oil crunch. The cheapest gas I can remember was back around 2000, when it was down to about 85 cents per gallon for a brief period. I can, however, look up gas prices historically- along with the price of silver over the years.

The California Energy Commission has a chart of gasoline prices in that state since 1970. In 1970 the price listed at the pump, on average, was about 34 cents- close enough to a quarter, when you allow that everything's more expensive in California. In the same year the average market price for one ounce of silver was $1.64. In 1970 an ounce of silver would buy four and a half gallons of gas.

In 1980 the price of gas in California was about $1.23 per gallon- one year short of its 1981 peak. At the same time the Hunt brothers were cornering the world silver market, driving its price up to $15.65. At that moment in history, one ounce of silver would buy twelve gallons of gas.

In 1990 the price of gas in California was $1.09. At the same time silver cost $4.17 per ounce. In twenty years the buying power of silver, in terms of gasoline, had gone from four and a half gallons to twelve gallons to slightly less than four gallons. In 2000 (1.66/$4.60=2 3/4 gallons) and in 2005 (2.17/8.83=4) the ratio continued to fluctuate. Today, in November 2007, the average nationwide price of gas is about $3.15 per gallon, and the price of silver is $14.51- in other words, one ounce of silver today buys, by total coincidence, the same amount it did in 1970, after nearly forty years of wild fluctuation.

What do these numbers show? First, they show that silver, like any commodity, is volatile in value. It has no absolute value- because there is no such thing as an absolute value. Something is worth only as much as someone is willing to exchange for it, and sometimes people are willing to give more to get silver than at other times. Leaving aside the Hunt brothers, silver (and gold) tend to go up in value during economic declines and down in value during boom periods; investors use the precious metals as a hedge against inflation and deflation alike.

Second, the numbers show that different commodities gain or lose value at different rates. In 1980, while gas prices were going up, silver prices were skyrocketing due to market manipulation. IN 2000, the dot-com bubble economy was beginning to drive gas prices up from their all-time lows in 1998, while at the same time the same economy kept silver prices depressed. Nailing a currency to one commodity does not give it any absolute buying power; instead, it ties that currency to the fluctuations of the commodity, or else ties the commodity's price to the fluctuations of the currency.

Back to NORFED, now:

Paper money backed only be government debt is bad for everyone!

Well, first, that's an absurd statement. Our current currency is not backed by debt; it's backed by the ability of the United States to pay off that debt when it comes due. That means that the more the federal government borrows, the less the dollar is worth on the world market.

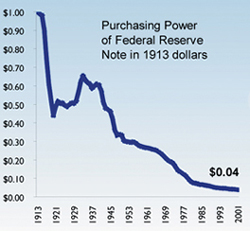

We can even use NORFED's own chart to demonstrate this:

If you'll notice, the first (and largest) drop in the value of the dollar coincides with World War 1. The second (and second largest) slide corresponds with World War II. The third major slide, from the mid-1960s through 1977, represents Vietnam and its aftermath. Only in the third case was American currency NOT backed by gold: the United States was on a fixed gold standard until 1971. It was massive borrowing, not just overprinting of currency, that caused the massive inflation of those periods.

Inflation outside these periods can primarily be attributed to banking: whenever money is loaned for a profit, a small amount of annual inflation is generated. If you'll look at the chart again, you'll notice that there are only three upward spikes: the post-war recession of 1919-1921, the Great Depression, the the Great Depression (temporarily overwhelmed, 1933-1937, by Roosevelt's borrowing binge), and the post-war malaise of 1946 (which ended when old New Deal and wartime price controls were removed). Deflation in the 20th Century walked hand in hand with bank collapse and economic crisis.

So it's not unbacked fiat money that causes the dollar to lose value; it's borrowing and loaning, and bankers taking their cut. The larger the cut, the greater the inflation... and bankers charge more to customers whose ability to pay is in doubt. The best way to control inflation would be to pay off the national debt- not to tie the currency being exchanged to some commodity.

(Oh, and by the way: a chart of gold and silver prices can be found in this Wikipedia article. The price of gold was fixed by Federal law to the dollar, as part of the gold standard, until 1971. During that period, when the dollar was in theory backed by gold, the dollar lost 80% of its value since 1913. Since then, gold has fluctuated from lows of about $200 per ounce to highs of $900 per ounce- more volatile even than silver. Never mind the fact that there's not one-tenth the amount of gold needed to back every dollar at current prices in the entire world- the gold standard, plain and simple, is no bulwark against inflation or market fluctuation.)

There's a larger point that von NotHaus misses: the Federal Reserve Note is NOT backed by debt, nor even (directly) by the United States' ability to pay its debts. The dollar's value is determined by what someone else is willing to exchange for it- just like any other commodity. Yes, the Federal Reserve Note, fiat money that it is, is also a commodity- it's a substance people buy and sell in the marketplace. So long as people have a use or desire for the dollar, it has value... just like silver, gold, oil, pork bellies, or any other commodity.

Onward:

Doesn't it just make sense that when the underlying commodity increases in value the purchasing power of the currency should increase in value? Well that is exactly what happened on Thanksgiving Day 2005 - the Liberty Dollar Moved Up from the $10 Silver Base to the new $20 Silver base and all Liberty Dollars DOUBLED in value. Just imagine, while your US Dollars are losing purchasing power, the Liberty Dollar is rewarding those who have started using the new gold and silver based currency by keeping pace with inflation, caused by the decline of the US Dollar.

Well, no, actually that does NOT make sense.

von NotHaus has used, as his prime selling point, that his Liberty Dollar does not suffer from inflation. However, at the same time he wants to offer the Liberty Dollar at par with the Federal Reserve Note- which more or less undermines his argument. In 2005 NORFED revalued its currency from a base of ten Liberty dollars per ounce of silver to twenty L-dollars per ounce. (Its gold certificates also doubled the face amount per ounce of gold.) Although an exchange from the old coinage to the new is available for a nominal fee, the fact remains that the abstract unit called the Liberty Dollar has lost half its value since its beginning in 1998- a track record no better, and by certain measures worse, than the United States dollar.

Onward again:

The Liberty Dollar was specifically designed circulate in the community for the advantage of the local economy and stay in the community, so REAL money may not be deposited into a bank. Because it cannot be whisked away, the Liberty Dollar will remain in your community - and circulate for the good of both the merchants and consumers.

So, if you want to use Liberty Dollars, you have to carry them around with you... you can't deposit them in a bank for safekeeping or to draw interest... you can't write checks or other bank drafts on them... and you can't use them for electronic purposes.

And this is an improvement over the United States dollar... how?

But let's back up a bit...

Just as FedEx brought competition to the Post Office and it became incredibly successful, the Liberty Dollar emulates the same model by bringing competition to our country's monetary system. Now you can become incredibly successful too.

We'll come back to the "incredibly successful" part in a bit; right now let's focus on "compete," which is the core reason why the Feds raided the Liberty Dollar offices.

Although NorFed gives examples from specific low-level representatives of the Secret Service and the U. S. Treasury Department that the Liberty Dollar is not counterfeiting (since it's not identical to US currency, nor does it say "legal tender" anywhere on it), the Department of Justice under Alberto Gonzales declared the Liberty Dollar illegal in September 2006. To quote the official government press release:

Under 18 U.S.C. § 486, it is a Federal crime to pass, or attempt to pass, any coins of gold or silver intended for use as current money except as authorized by law. According to the NORFED website, "Liberty merchants" are encouraged to accept NORFED "Liberty Dollar" medallions and offer them as change in sales transactions of merchandise or services.

NORFED tells "Liberty associates" that they can earn money by obtaining NORFED "Liberty Dollar" medallions at a discount and then can "spend [them] into circulation."

NORFED’s "Liberty Dollar" medallions are specifically marketed to be used as current money in order to limit reliance on, and to compete with the circulating coinage of the United States. Consequently, prosecutors with the United States Department of Justice have concluded that the use of NORFED’s "Liberty Dollar" medallions violates 18 U.S.C. § 486, and is a crime.

von NotHaus responded by suing the federal government.

For those curious, the exact text of United States Code of law, Title 18, Section 486, is:

Whoever, except as authorized by law, makes or utters or passes, or attempts to utter or pass, any coins of gold or silver or other metal, or alloys of metals, intended for use as current money, whether in the resemblance of coins of the United States or of foreign countries, or of original design, shall be fined under this title (amended 1994 to cap fines at $3,000 per offense) or imprisoned not more than five years, or both.

von NotHaus's response to this has been threefold: (1) the US Mint has no right or power to enforce law; (2) the Liberty Dollar does not advertise itself as legal tender, and therefore is not in violation of this law; and (3) the federal government is abusing its power to enforce its money monopoly.

First, if you go back and look at that press release, you'll notice that it doesn't say the Treasury or the Mint determined the Liberty Dollar is a crime: the exact quote is, "Prosecutors with the Department of Justice have determined that the use of these gold and silver NORFED "Liberty Dollar" medallions as circulating money is a Federal crime." So much for von NotHaus's first point.

As for the second point, the Liberty Dollar is advertised to be used in place of government-authorized currency, in an attempt to drive the Federal Reserve Note out of circulation entirely. Liberty Dollar owners are encouraged to use them to buy and sell goods and services- in short, as money. 18 U.S.C. § 486 does not contain the words "legal tender" anywhere in it; it is the act of circulating unauthorized coins as money that is the crime, and on that definition von NotHaus is guilty as hell.

As for the final point, the idea that government monopoly is evil appeals to the anarchist mindset... which tends to be wilfully blind of historical fact. In the 19th Century there were hundreds of private currencies- specifically, paper notes issued by banks, authorized but not backed by the state and federal governments of the time. The bank notes competed and fluctuated wildly in value according to the stability of the banks and other economic conditions... and when the banks failed, as they did quite often, the notes became worthless. Competing currencies brought not economic freedom, but economic chaos and destruction. The key to a stable economy is a single, uniform currency. The founders knew this, having had hard experience with competing (and often worthless) state-issued currencies. That's why the Constitution gives the federal government its monopoly on coining money: to protect the property of all American citizens.

And now, for the final, the most contemptible, the most damning aspect of the Liberty Dollar: it's a scam.

When NORFED first began, it set the value of its Liberty Dollar at $10 per ounce of silver and $500 per ounce of gold. At the time (1998) the price of silver was about $4.50 per ounce, and the price of gold about $280. Today the Liberty Dollar is valued at $20 per ounce of silver and $1,000 per ounce of gold... with today's market prices of $14.50 per ounce of silver and $787.00 per ounce of gold.

While von NotHaus decries the mint for making a massive profit on producing money, he's doing the exact same thing... stealing part of the supposed absolute buying value of silver and gold for his own benefit.

Well, now the pigeons are coming home to roost. Federal investigators have shut down the Liberty Dollar and confiscated all the company's assets. Arrest warrants are only a matter of time, and likely not much time at that. When the case comes, it will likely be airtight... and Bernard von NotHaus will spend a few years in the Federal penitentiary.

Tragically, thanks to his slick sales pitch, double-talking, and above all the basic distrust of government that defines libertarianism, he's taking a lot of people with him. Dozens of arrests around the country have been made for people using Liberty Dollars as they would US dollars. People are facing tens of thousands of dollars in legal fees and fines- to say nothing of jail time- for purchases as small as $1. These people didn't seek to defraud anyone; they honestly believed that they were using money better than the government makes. They are innocent victims caught up in a scam designed to wring money out of gold-bugs, conspiracy theorists, and others who want less government power in our lives.

The same cannot be said of...

Bernard von NotHaus, for scamming hundreds of thousands of people, for creating funny money and for embarrassing all opponents of excessive government... this week's Corn Flake!

(Oh, and about those Ron Paul Dollars: I had no idea Paul was stupid enough to allow a counterfeiter and con man like von NotHaus to use his name and likeness to promote his scam. This could become another Presidential stumbling block, should Ron Paul openly defend von NotHaus when (not if) he's arrested and brought to trial...)

3 comments:

Well done! Thank you in particular for the historical research; this is now a place where I can direct people who might be confused about the issues in question.

This post is so full of untruths and inaccuracies I don't know where to begin.

World War I saw the suspension of the gold standard. Duh.

World War II saw, for all intents and purposes, the end of the gold standard for individuals. Duh.

Vietnam could not be funded with a dollar that was even nominally tied to gold, so the gold standard was revoked entirely to make war more easily fundable. Duh.

These are the causes for the major dips in the dollar's purchasing power.

Secondly, your understanding of Gresham's Law is totally inaccurate. Bad money drives good money out of circulation only when that bad "money" is money by government decree, and only when that government is still powerful enough to enforce its legal tender laws. When the dollar's purchasing power drops several hundred percent per day -- which will happen in our lifetimes unless drastic and entirely unlikely action is taken by our monetary and political architects -- even the most repressive police state imaginable will not be able to enforce legal tender laws, and people will revert to REAL MONEY (a commonly accepted means of exchange).

Fed Notes have value because the government's guns say they do, and the government accepts them for payment in taxes. Hooray. We have a currency that derives 100% of its value from the power of the state. What a godsend that we have such a powerful central government.

The gold standard remained on international payments until 1971. The dollar remained indexed to gold, at different rates, until that point, when Nixon suspended gold payments to foreign nations. Ford completed the job in 1974.

(And also you're quite in error about the gold standard being touched in World War II. The law making it illegal for private citizens to own non-jewelry gold was passed in 1934, not 1939 or later. As NORFED's own charts show, this measure had no effect one way or another on long-term inflationary or deflationary trends.)

My understanding of Gresham's Law is quite correct. The Liberty Dollar (presumably the "good" money, backed by metal as Gresham himself preferred) seeks to drive out the US Dollar (the "bad" money, the fiat money Gresham opposed) in a system where legal tender laws are enforced (as has just been demonstrated in Evansville). This plan can only work if the legal tender laws are violated- if people refuse to accept the US Dollar.

As for your final point... you sure do seem anxious to see our society and economy collapse, see millions of people peniless and desperate, see the rule of law destroyed, just so you can say, "See? I was right."

NOT the kind of person I, for one, would want to put in any position of responsibility.

Post a Comment